Feb 11, 2026

• blog

What Institutional-Grade Crypto Trading Actually Means

in this article

Cross Exchange Funding Rate Arbitrage

A classic strategy in digital systematic trading, cross-exchange funding rate arbitrage is conceptually straightforward. That conceptual clarity, however, often creates the false impression that running the strategy is easy.

The payoff function is simple: collect funding payments while neutralizing directional exposure. The complexity lies not in the funding mechanic itself, but in signal quality, execution, and risk management, particularly counterparty risk. These are the areas that are consistently underestimated and where poorly constructed strategies fail.

What are Funding Rates?

Funding rates are an embedded mechanism in perpetual futures contracts designed to anchor the contract price to the spot market.

In traditional finance, arbitrage requires identifying mispricing relative to a model or theoretical fair value. In crypto perpetual markets, this alignment mechanism is explicit: funding payments directly incentivize convergence between perp and spot prices.

If perpetual trades below spot:

Shorts pay longs

→ NEGATIVE funding rate

If perpetual trades above spot:

Longs pay shorts

→ POSITIVE funding rate

The side paying funding is effectively compensating the other side to maintain the imbalance in positioning.

Because funding is observable and scheduled (often every 8 hours), it appears to offer a mechanically predictable return stream. Traders may conclude that simply taking the receiving side of funding is sufficient to generate profits.

That conclusion is incomplete.

Why is Receiving Funding not Enough?

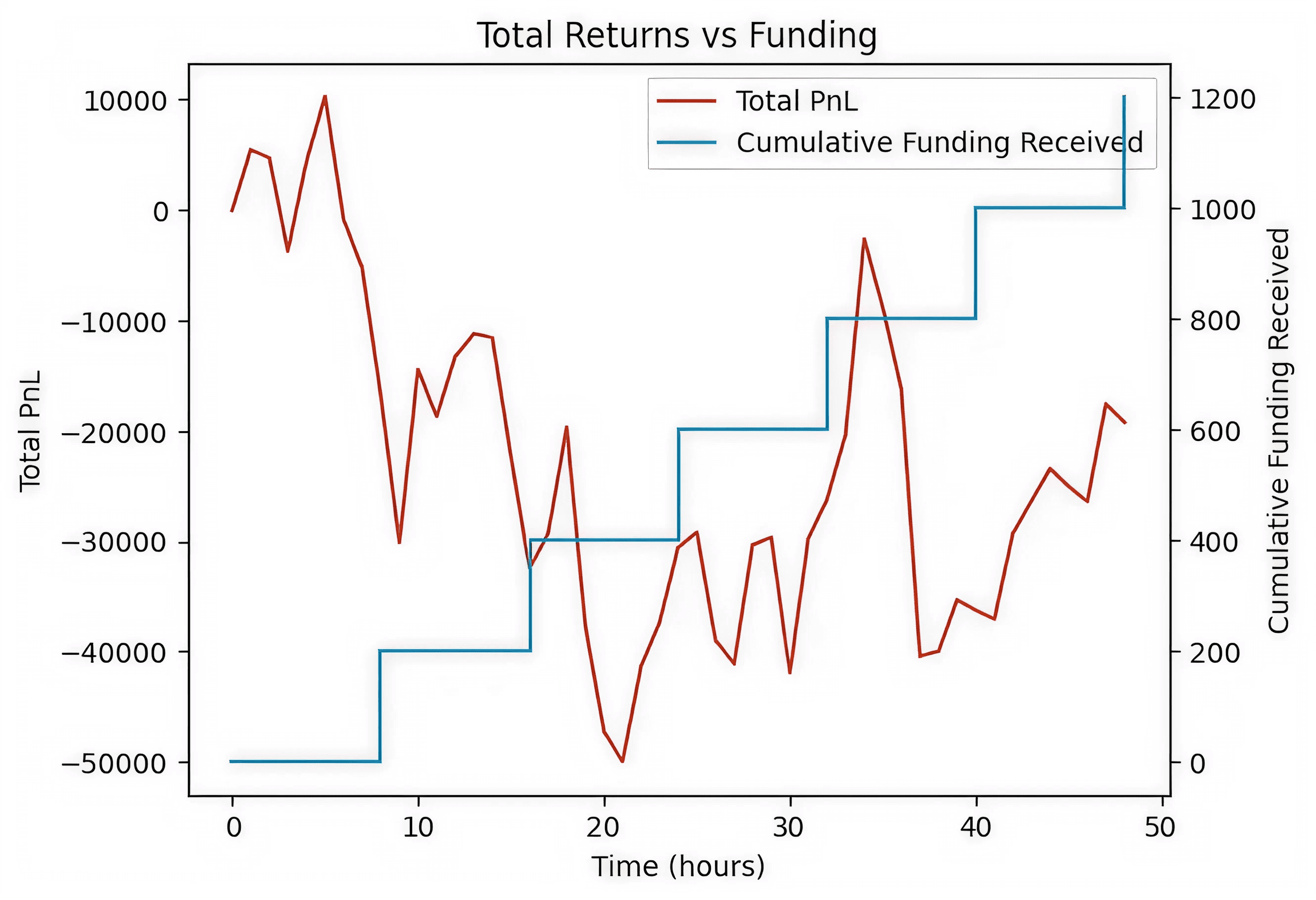

Example:

Let token ABC have:

Spot price = 100

Perpetual price = 98

Because spot > perp, funding is set at -0.2% every 8 hours (shorts pay longs).

Seeing this, you open a $100,000 long position in the perp to collect funding.

After 2 days (6 funding intervals), you receive:

0.2% × $100,000 × 6 = $1,200

However, suppose during those two days:

Spot drops from 100 → 80

Perp drops from 98 → 78

Your position loses:

$20 per unit × position size

≈ $20,400 mark-to-market loss

Net result:

Funding received: +$1,200

Price loss: -$20,400

Total PnL: -$19,200

This is classical delta exposure, sensitivity to changes in the underlying price.

This scenario may at first appear unrealistic: where an asset can fluctuate 20% in a few days. In reality, for crypto markets, the tokens exhibiting high volatility and liquidity fragility are often the same tokens that are capable of sustaining elevated funding rates. The funding stream may be positive, but the directional risk factor dominates.

So how does an arbitrageur isolate funding without absorbing this price risk?

Cross-Exchange Arbitrage

At its core, much like funding rates, arbitrage is simple.

An arbitrageur takes two offsetting positions to isolate pricing differential and neutralize exposure to the underlying asset.

The objective is not to predict direction. It is to capture the spread between the two positions.

Consider a simple example:

Distributor A buys and sells apples at $10 and $12.

Distributor B buys and sells apples at $14 and $16.

An arbitrageur can buy from A at $12 and sell to B at $14, capturing a $2 spread.

Now suppose the overall price of apples falls by $2.

Distributor A adjusts to $8 / $10.

Distributor B adjusts to $12 / $14.

The absolute price of apples changed.

The spread did not.

The arbitrageur still earns $2.

How can a smart trader take advantage of this for funding rates?

The most common approach, and the one that’s actually at the core of Blockhouse’s strategy, is to identify funding rates for the same token that reflect opposing imbalances.

At first glance, this seems counter-intuitive.

A perpetual contract cannot simultaneously trade above and below its spot price on the same exchange. So how can there be opposing funding opportunities for the same asset?

The answer lies in cross-exchange fragmentation.

Each exchange operates its own order book, margin system, and funding calculation. While spot prices for major tokens tend to be highly correlated across venues, perpetual prices, and therefore funding rates, are determined locally. If one exchange has excess demand for leverage longs, its perpetual will trade rich and funding will turn positive. If another exchange has excess demand for shorts, its perpetual may trade below spot and funding will turn negative.

In other words, the same token can exhibit opposite funding conditions across different venues at the same time.

Why does this persist?

Because crypto markets are structurally fragmented.

Capital is siloed across exchanges

Moving funds takes time and incurs opportunity cost

Fee tiers incentivize traders to concentrate volume on a single venue

Margin systems and collateral requirements differ

Regulatory and jurisdictional differences limit participation

Unlike traditional finance, there is no unified clearing infrastructure ensuring instantaneous convergence. These frictions prevent perfect arbitrage and allow funding spreads to persist long enough to be harvested systematically.

With this structure in place, the arbitrageur can construct offsetting positions across exchanges. And so, returning to our earlier example:

Let token ABC have spot price of 100

On Exchange A:

Perp price = 98

Spot > perp → funding = -0.2% every 8 hours (shorts pay longs)

On Exchange B:

Perp price = 102

Spot < perp → funding = +0.2% every 8 hours (longs pay shorts)

You open:

$50,000 long on Exchange A

$50,000 short on Exchange B

After 2 days (6 funding intervals), you receive:

0.2% × $100,000 × 6 = $1,200

This is the exact same returns as the first scenario.

Again, suppose during those two days:

Spot drops from 100 → 80

Exchange A Perp drops from 98 → 78

Exchange B Perp drops from 102 → 82

Your long loses:

$20 per unit × position size

≈ $10,200 mark-to-market loss

But your short position gains:

$20 per unit × position size

≈ $9,800 mark-to-market gain

Net result:

Funding received: +$1,200

Price loss: -$400

Total PnL: +$800

In this delta-neutral configuration, the sensitivity to the underlying price has been materially reduced. The return is driven primarily by the relative funding imbalance rather than by the direction of ABC itself.

Some residual basis risk always exists. As shown in this example, spreads do not converge perfectly and liquidity conditions vary. But for the same tokens, even across exchanges, large and persistent spot divergences across exchanges are rare due to spot arbitrage opportunities. Regardless, the dominant driver now becomes the funding differential.

Just That Easy?

This is where most strategies fail.

The same structural fragmentation that creates opportunity is almost always the same one that introduces risk to the strategy.

As such, Blockhouse approaches funding arbitrage not as a trade, but as a systematic market infrastructure problem.

1. Identifying Durable Alpha

Scraping funding rates across exchanges to find which tokens exhibit point-in-time funding differential is trivial. Identifying durable, risk-adjusted alpha is not.

The difference between headline funding and deployable funding is significant.

Key considerations include:

Persistence and stability of funding spreads

Liquidity depth on both legs

Entry and exit fee impact across fee tiers

Expected holding period versus spread half-life

Slippage under stress conditions

Capital efficiency under exchange-specific margin rules

High funding is frequently correlated with crowding, leverage imbalance, and liquidation risk. Many apparent opportunities look attractive on a dashboard but collapse after fees, slippage, and turnover costs.

A serious funding arbitrage strategy cannot simply rely on snapshots. It requires predictive and historical analysis across regimes, bull markets, deleveraging cascades, liquidity contractions, and exchange outages.

Blockhouse’s models evaluate funding quality, not just funding magnitude. Capital is allocated selectively to spreads that demonstrate persistence, sufficient liquidity, and positive expected net return after these adverse factors.

This is the difference between harvesting noise and harvesting structural inefficiency.

Stay informed on institutional crypto infrastructure

2. Counterparty Risk – Auto-Deleveraging (ADL)

Due to the delta-neutral property of the arbitrage strategy, some traders overlook the inherent risks involved by engaging in the fragmented crypto market. These risks are treated as tail events and edge cases and are not fully accounted for or embedded into the automated trading systems. Delta neutrality eliminates directional exposure. It does not eliminate exchange risk.

One such risk is auto-deleveraging, and just like funding rates, it is a core design feature of perpetual futures markets. It is not just an edge case.

The basic function is this: when liquidations exceed the capacity of an exchange’s insurance fund, profitable traders may be forcibly reduced to stabilize the system.

In a cross-exchange book, this can:

Break hedge symmetry

Close only one leg of a paired position

Introduce unintended directional exposure

Occur precisely during volatility spikes

ADL mechanisms vary across exchanges. Ranking systems, leverage tiers, unrealized PnL thresholds, and insurance fund health all influence exposure.

Therefore, Blockhouse treats ADL as a modeled variable, not a surprise. Exposure sizing, venue weighting, and capital allocation incorporate exchange-specific ADL risk metrics. During periods of elevated systemic stress, exposure is dynamically reduced.

The objective is not to purely maximize funding in stable markets. It is also to preserve capital when the market structure itself is unstable.

3. Counterparty Risk – Delisting

Delisting risk is equally underestimated.

The tokens that generate the most attractive funding spreads are often those with:

Thin liquidity

Unstable governance

Regulatory ambiguity

Elevated volatility

These same characteristics increase the probability of contract suspension or delisting.

Once a delisting announcement is made:

Liquidity deteriorates rapidly

Volatility increases

Spread behavior becomes unstable

Settlement mechanics vary across exchanges

Even a delta-neutral book can experience abrupt mismatches if unwind procedures are not pre-modeled.

Once a delisting event is announced, that token will no longer be able to be bought. This creates a significant amount of volatility as traders rush to sell the token. This may at first be seen as an attractive increase in profits on charts as our delta-neutral position surges on the expanding funding differential, but the moment the token is delisted, the resulting settlement and closure of positions may surprise unsuspecting traders with unexpectedly poor prices.

Blockhouse embeds contract lifecycle monitoring, delisting probability scoring, and automated unwind logic into its trading infrastructure. Delisting is treated as an expected lifecycle event in a fragmented market, not an anomaly to be handled manually.

This allows us to transform a structural vulnerability into a managed variable, one that we can take advantage of to harvest the excess funding rates and gracefully exit positions before settlement forces an exit.

How to Stay Profitable

The risks discussed above, alpha decay, ADL, and delisting, are not edge cases. Funding arbitrage exists because crypto markets are inefficient and capital is segmented. But that same fragmentation introduces:

Exchange-level counterparty risk

Rule-change risk

Liquidity discontinuity

Operational complexity

All of these must be monitored and systematically managed.

Yes, conceptually, capturing funding is indeed simple.

It is like kicking a soccer ball into a goal. The mechanics are straightforward. Just get the ball in the net. But the outcome depends on the field conditions, the referee’s rulebook, whether the opposition is cheating, and whether the match is even allowed to continue.

In digital asset markets, the ecosystem matters as much as the strategy itself, and as such, sustaining funding returns requires:

Robust signal modeling

Venue-aware execution systems

Continuous counterparty risk monitoring

Automated responses to structural events

Blockhouse’s advantage does not lie in identifying that funding exists. That is obvious. It lies in building the infrastructure required to harvest it responsibly, repeatedly, and at scale.

Access to Back-tests

We provide detailed back-tests across exchange pairs, margin currencies, and fee tiers. And we encourage interested parties to inquire into back-tests, which are offered for free before beginning any strategies.

Our analysis incorporates:

Real-world fee structures

Slippage and liquidity constraints

Regime segmentation

Out-of-sample validation

Drawdown and tail-risk metrics

We make no assumptions about the rocky stage that is the digital asset space.

Institutional allocators evaluate systematic strategies net of friction and under stress. Our framework reflects that standard.

We invite you to schedule a demo to review customized back-tests tailored to your venue preferences and fee structures.